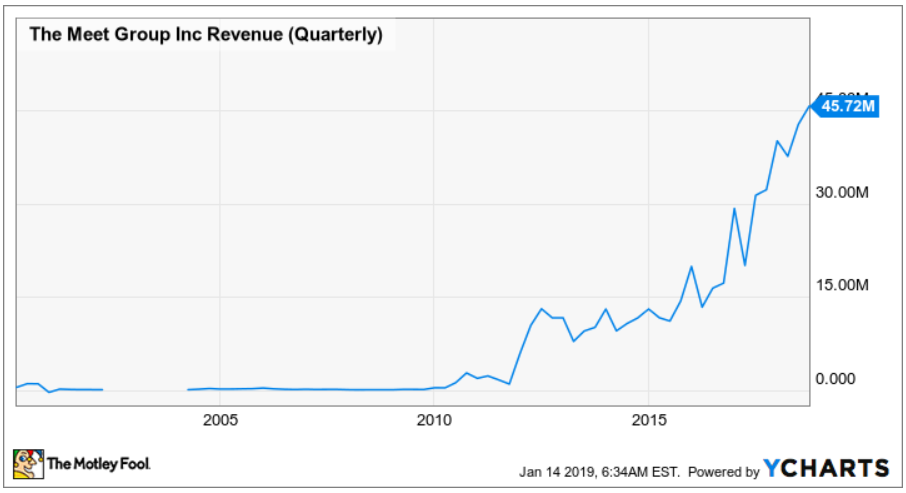

Shaers of The Meet Group, Inc. (NASDAQ:MEET) have been recommended as a long term growth pick according to Beta Research. With the firm’s stock price currently trading around $3.67, the firm has proven a solid track record of growth over the past few years. Investors might consider the stock as a long term growth candidate as the firm has yielded 15.50% earnings per share growth over the past 5 years and 34.60% revenue growth over that same time frame.

Investors looking to make big gains in the equity market may be looking to fine tune an existing strategy or create a whole new one. It may sound quite easy, buy low and sell high. Obviously, navigating the stock market typically entails much more than that. Identifying market tops and correction levels may be very difficult. Of course, it always hurts to take a loss, but figuring out how to shrink losses can help keep the ship afloat during turbulent market conditions. The situation for the average investor may vary greatly from one person to the next. Some investors will be working with a short-term plan, while other may be focused on a longer-term investment horizon. Goals may also vary from individual to individual. Keeping these goals in sight may help clear up the sometimes foggy investing waters, and provide clarity for creating a winning portfolio.

Occasionally, investors may feel like they are riding on a wild roller coaster when dealing with the stock market. Controlling emotions when taking the ride may assist with making necessary decisions when the time comes. Many investors choose to do thorough research when purchasing any stock. Knowing what is owned and why it is owned may help ease the mind when things get sticky. When the market is riding high and there is generally smooth sailing on the investing seas, individual investors may have the tendency to get complacent. Being prepared for any situation may help ease the stress of big market decision making. There may be a time when it seems like everything is going off the rails, but having an actual game plan for management and recovery could make a huge difference both financially and psychologically.

| Just-released report names Cannabis Stock of the Year for 2019! Their last pick has seen a +1,200% return since he released it!

This stock has all of the makings of the next great cannabis stock – early-mover advantage, international exposure and influential partnerships, plus it has a product that is unlike anything else on the market… |

Recent Performance

Let’s take a look at how the stock has been performing recently. Over the past twelve months, The Meet Group, Inc. (NASDAQ:MEET)’s stock was -18.14%. Over the last week of the month, it was 9.86%, -33.16% over the last quarter, and -34.43% for the past six months.

Over the past 50 days, The Meet Group, Inc.’s stock is -17.53% off of the high and 20.33% removed from the low. Their 52-Week High and Low are as follows: -41.47% (High), 20.33%, (Low).

Analyst Recommendation

Despite the past success, investors want to know where the stock is headed from here. Analysts covering the shares have a consensus short-term price target of $7.25 on the equity. Analysts have a consensus recommendation of 1.60 based on a 1 to 5 scale where 1 represents a Strong Buy and 5 a Strong Sell.

As most investors most likely have learned, there is no easy answer when deciding how to best take aim at the equity market, especially when faced with a volatile investing scenario. There are many different views when it comes to trading stocks. Investors may have to first come up with a plan in order to build a solid platform on which to compile a legitimate strategy. The vast amount of publically available data can seem overwhelming for novice investors. Making sense of the sea of information may do wonders for the health of the individual investor’s holdings.

Kaufman Adaptive Moving Average Trending Up for Federal Signal Corp (FSS)

Kaufman Adaptive Moving Average Trending Up for Federal Signal Corp (FSS)  Checking on the Valuation For Shares of Zymeworks Inc. (TSX:ZYME), Talend S.A. (NasdaqGM:TLND)

Checking on the Valuation For Shares of Zymeworks Inc. (TSX:ZYME), Talend S.A. (NasdaqGM:TLND)  Consensus EPS Watch for Royal Caribbean Cruises Ltd. (NYSE:RCL)

Consensus EPS Watch for Royal Caribbean Cruises Ltd. (NYSE:RCL)  Estimates in Focus for Shares of Royal Caribbean Cruises Ltd. (NYSE:RCL)

Estimates in Focus for Shares of Royal Caribbean Cruises Ltd. (NYSE:RCL)  Caribbean Holdings International Corp (CBBI): Watching the Stochastic RSI on This Stock

Caribbean Holdings International Corp (CBBI): Watching the Stochastic RSI on This Stock  Signal Update on Shares of Imax Corp (IMAX): Weighted Alpha Hits -3.90

Signal Update on Shares of Imax Corp (IMAX): Weighted Alpha Hits -3.90